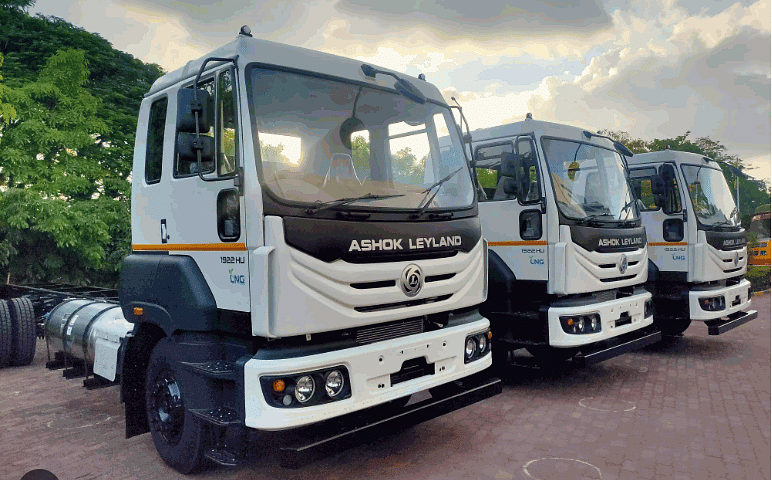

Ashok Leyland’s Q3 net profit jumps 60% YoY to Rs 580 crore

Ashok Leyland posted strong growth of 60% in its standalone net profit for the October-December quarter despite a low-single-digit growth in its revenue as the company managed to improve its margins considerably on the back of better price realisation and lower input cost.

The commercial vehicle major’s standalone profit for the quarter came in at Rs 580 crore, compared with Rs 361 crore in the year-ago quarter. Revenue from operations grew 2.7% on year to Rs 9,273 crore. The revenue growth was restricted to low-single digits because of the marginal decline in the number of vehicles sold.

The flagship of the Hinduja Group sold a total of 47,241 commercial vehicles during the quarter, down from 47,568 units in the year-ago quarter. This decline can be attributed to the weakness in the medium and heavy commercial vehicle segment. The volumes were slightly higher in the light commercial vehicle segment. Exports, however, registered a growth of 6.5% to 3,128 units.

Also Read: Ashok Leyland delivers first 14T Boss Electric Truck to BillionE at Bharat Mobility Global Expo 2024

The weakness in overall volumes was offset by higher realisation from price hikes and mix, and lower input costs. This is reflected in the company’s operating performance. Earnings before interest, taxes, depreciation and amortisation (EBITDA) rose around 40% to Rs 1,114 crore while EBITDA margin, or operating profit margin, expanded to 12% from 8.8% in the year-ago quarter.

“The current quarter saw the confluence of good volumes, better price realisation, and higher cost savings, thus helping us achieve better profitability. Other businesses such as After-market, Power Solutions and Defence also continue to strongly contribute to our top line and margins,” Managing Director and Chief Executive Officer Shenu Agarwal said.

Also Read: Tata Motors introduces 'Karo Life Control Mein' campaign on fleet edge telematics platform

The company's total expenses during the quarter dropped by 1.2% on the year to Rs 8,399 crore because of the decline in the cost of materials and services consumed. The cost of materials and services consumed fell 9% during the quarter to Rs 6,555 crore. Also, the cost of materials and services as a percent of revenue from operations came down to 70.7% from 79.8% in the comparable period.

Future outlook

Going forward, the company plans to continue with its strategy to improve the margins with new products, cost optimisation, and pricing, and remains optimistic about growth in the commercial vehicle industry over the medium and long term.

“On back of new differentiated products, deeper focus on cost optimisation, and with continued discipline on pricing, we shall relentlessly pursue improvement in profitability. We remain confident and optimistic about the growth of the CV industry in the medium and long term as macroeconomic factors continue to be favourable,” Agarwal said.

Investors and stakeholders can take confidence in Ashok Leyland's ability to deliver consistent growth and generate value. The company's impressive Q3 results demonstrate their commitment to shareholder value and their ability to outperform industry expectations.

Overall, Ashok Leyland's Q3 performance showcases their strength as a market leader, their ability to adapt to changing market dynamics, and their commitment to delivering superior financial results. With a positive outlook and a track record of success, Ashok Leyland is well-positioned for continued growth and profitability in the future.

Latest Truck News

View All Truck NewsRecent Posts

- Tata Ultra T.7 बनाम Ashok Leyland Partner 4-Tyre: LCV सेगमेंट में आमने-सामने की टक्कर

- टाटा 1816 LPT की कीमत, माइलेज और लोड कैपेसिटी: पूरी जानकारी

- Truck Makers Collaborate with Amazon, Amul & Others for Electric Small Commercial Vehicles

- Tata 1816 LPT Price, Mileage, and Load Capacity: Everything You Need to Know

- Top 5 Bharat Benz Trucks for Heavy-Duty Applications in 2025

- टॉप 5 BharatBenz हैवी-ड्यूटी ट्रक्स 2025 के लिए

- मारुति सुजुकी ने सुपर कैरी मिनी ट्रक में ईएसपी जोड़कर सुरक्षा बढ़ाई

- Maruti Suzuki Boosts Safety with ESP in Super Carry Mini Truck

- भारत में सबसे ज्यादा बिकने वाले हल्के वाणिज्यिक वाहन (LCV): टाटा ऐस बनाम महिंद्रा जीतो बनाम अशोक लेलैंड दोस्त

- Best Selling Light Commercial Vehicles (LCVs) in India: Tata Ace vs. Mahindra Jeeto vs. Ashok Leyland Dost

Popular Three Wheelers Brands

Altigreen

Altigreen Euler Motors

Euler Motors Mahindra

Mahindra Piaggio

Piaggio Bajaj

Bajaj Greaves Mobility

Greaves Mobility ATUL

ATUL TVS

TVS Omega Seiki Mobility

Omega Seiki Mobility Kinetic

Kinetic Lohia

Lohia JSA

JSA YC Electric

YC Electric Udaan

Udaan SN Solar Energy

SN Solar Energy Saarthi

Saarthi Teja (Powered by Greaves)

Teja (Powered by Greaves) Jezza Motors

Jezza Motors GreenRick

GreenRick City Life Electric

City Life Electric Ampere

Ampere Baba Electric

Baba Electric E-Ashwa

E-Ashwa Bahubali E Rickshaw

Bahubali E Rickshaw Dabang

Dabang Deltic

Deltic Keto Motors

Keto Motors Mini Metro

Mini Metro Gayam Motors

Gayam Motors Gem EV

Gem EV Gkon Automotive

Gkon Automotive Skyride

Skyride Thukral Electric

Thukral Electric Baxy

Baxy Eblu

Eblu Hexall

Hexall Joy

Joy Montra

Montra Star

Star Dandera

Dandera EKA

EKA Khalsa

Khalsa Hero

Hero- Zero21

91trucks is a rapidly growing digital platform that offers the latest updates and comprehensive information about the commercial vehicle industry.