Indian Auto Component Industry Records Robust 11.3% Growth in H1 2024-25

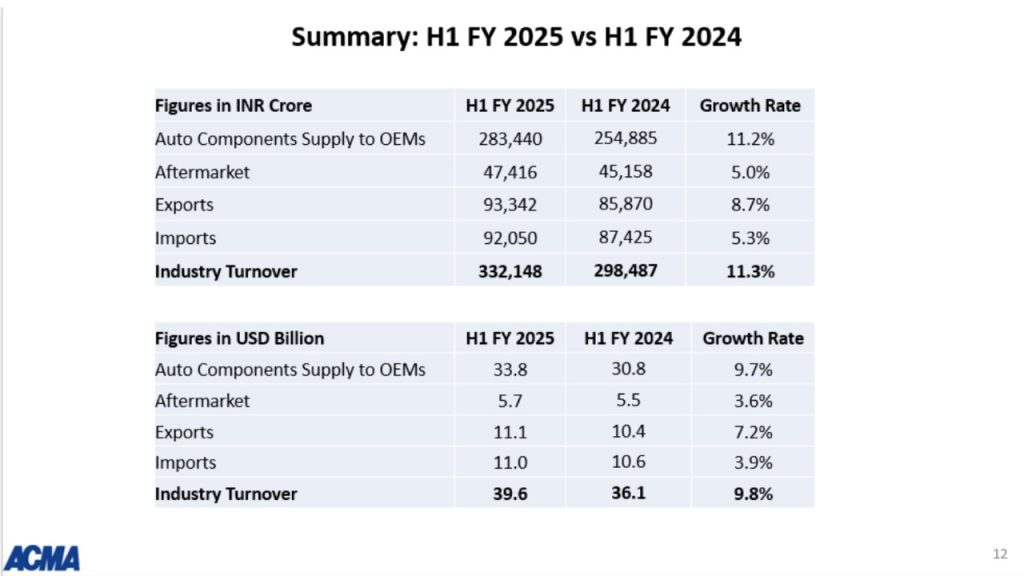

New Delhi, December 12, 2024: The Indian auto component industry has shown remarkable resilience and growth in the first half (H1) of fiscal year 2024-25, achieving an impressive 11.3% increase in turnover to ₹3.32 lakh crore (USD 39.6 billion). This performance, driven by consistent demand from both domestic and international markets, was highlighted in the latest Industry Performance Review released by the Automotive Component Manufacturers Association of India (ACMA).

Strong Growth Across Segments

Exports: Exports of auto components grew by 7% to USD 11.1 billion (₹93,342 crore) during H1 2024-25 compared to USD 10.4 billion (₹85,870 crore) in the same period of the previous year. North America led this growth with an 8.3% increase, accounting for 31% of total exports. Asia followed closely, witnessing a 10% rise, while exports to Europe, which also accounted for 31%, remained steady.

Imports: On the import front, the industry recorded a 4% growth, with imports rising to USD 11 billion (₹92,050 crore) from USD 10.6 billion (₹87,425 crore) in H1 2023-24. Asia continued to dominate as the primary import source, contributing 65% of total imports, followed by Europe at 27% and North America at 7%. Imports from Asia grew by 5.5%, while those from Europe increased by 3.2%. However, imports from North America declined by 8.3%.

Domestic Market: Auto component supplies to Original Equipment Manufacturers (OEMs) in the domestic market grew by 11.2%, reaching ₹2.83 lakh crore (USD 33.8 billion). The growth was attributed to the increasing consumption of high-value components and a market preference for larger, more powerful vehicles.

Aftermarket: The aftermarket segment also registered a healthy 5% growth, reaching ₹47,416 crore (USD 5.7 billion). E-commerce played a significant role in this growth by enhancing the penetration of spare parts and components, especially in rural areas, and driving the sector towards greater organization.

Industry Leadership Perspectives

Vinnie Mehta, Director General, ACMA, credited the sector’s performance to steady vehicle sales and robust export demand. "The auto component industry’s turnover of ₹3.32 lakh crore reflects a strong 11.3% growth. Supplies to OEMs, exports, and the aftermarket remained consistent contributors, indicating a healthy and resilient industry."

Shradha Suri Marwah, President, ACMA, highlighted the challenges and opportunities ahead. “Despite geopolitical challenges affecting exports, the sector demonstrated steady growth in both domestic and international markets. While passenger and commercial vehicle sales have been moderate, two-wheelers have shown promising growth. Investments in technology upgradation, localization, and value addition continue to strengthen the industry’s global competitiveness,” she said.

Investment and Technological Advancements

The Indian auto component sector is actively investing in cutting-edge technology, localization efforts, and value addition to meet the evolving needs of both domestic and international customers. The focus on innovation and sustainability is poised to further bolster the sector's growth trajectory.

Outlook

With a stable and growing market, the auto component industry remains optimistic about its prospects. While challenges such as rising freight costs and geopolitical uncertainties persist, the sector’s adaptability and focus on long-term growth strategies ensure a bright future.

As India continues to cement its position as a global automotive hub, the auto component industry is poised to play a pivotal role in driving innovation, employment, and economic development.

About ACMA

The Automotive Component Manufacturers Association of India (ACMA) is the apex body representing the interest of the Indian Auto Component Industry. Its membership of over 1,000 manufacturers contributes more than 90% of the auto component industry’s turnover in the organized sector.

नवीनतम Auto Expo समाचार

सभी Auto Expo समाचार देखेंलोकप्रिय ट्रक ब्रांड

लोकप्रिय बस ब्रांड

लोकप्रिय तिपहिया वाहन ब्रांड

- अल्टीग्रीन

- यूलर मोटर्स

- महिंद्रा

- पियाजियो

- बजाज

- ग्रीव्स मोबिलिटी

- अटुल

- टीवीएस

- ओमेगा सेइकी मोबिलिटी

- किनेटिक

- लोहिया

- जेएसए

- वाईसी इलेक्ट्रिक

- उड़ान

- एसएन सोलर एनर्जी

- सारथी

- तेजा (ग्रीव्स के पावर से)

- जेज़ा मोटर्स

- ग्रीनरिक

- सिटी लाइफ इलेक्ट्रिक

- अम्पीयर

- बाबा इलेक्ट्रिक

- ई-आश्वा

- बाहुबली ई रिक्शा

- डाबंग

- डेल्टिक

- केटो मोटर्स

- मिनी मेट्रो

- गयाम मोटर्स

- जेम ईवी

- जीकॉन ऑटोमोटिव

- स्काईराइड

- ठुकराल इलेक्ट्रिक

- बैक्सी

- ईब्लू

- हेक्सॉल

- जॉय

- मोंट्रा

- स्टार

- डैंडेरा